How to account for inventory shipping costs in QuickBooks

According to generally accepted accounting principles, the value of inventory is any and all costs incurred to get the product ready for sale. This includes any costs associated with receiving the product, including shipping fees (also known as inbound freight). When you add the shipping costs to inventory, the process is referred to as capitalization and it gives you a better representation of cost of goods sold.

Let’s take a look at a brief example of how to account for shipping costs. Assume you own a retail business that buys and resells widgets. You buy the widgets from your supplier at a cost of $5.00 each. You order 100 widgets and are charged $500.00 plus $50.00 for shipping the widgets to your warehouse. The average inventory valuation cost for each widget should no longer be just $5.00, it should be $5.50 in order to reflect the additional cost to get the items ready for resale (100 widgets purchased for $500 plus $50 for shipping).

Now let’s see how this example should be handled in QuickBooks Pro and Premier.

There are two different methods of accounting for this depending on how you are billed for the shipping costs.

If you are billed for the shipping by your supplier on the invoice for the widgets then just distribute the shipping costs between the items purchases. In the example above we would simply add the $50.00 to the amount we paid for the 100 widgets.

If you are billed separately through a third party vendor, there are a few extra steps in order to account for these costs properly.

First you would enter the invoice from your supplier for the widgets purchased. After you do this your inventory valuation per item in the above example will be $5.00.

The next step would be to create an expense account in your chart of accounts called “Clearing Shipping Expense”. When you receive the bill for the shipping expense from the third party, you will enter the $50 into this Clearing Shipping Expense Account.

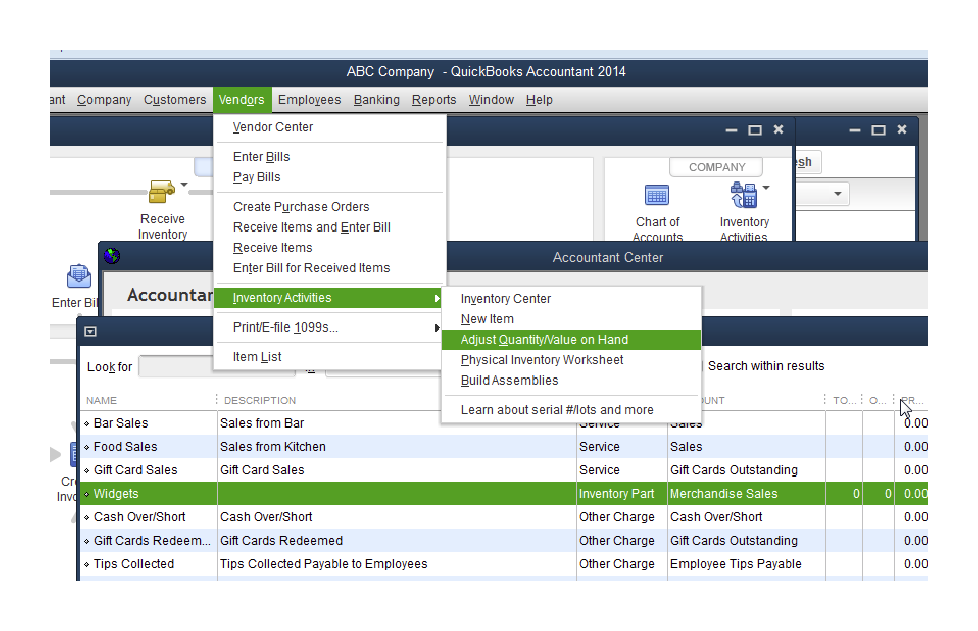

The last step will be to adjust to inventory valuation. You do this in QuickBooks 2014 by clicking Vendors>Inventory Activities>Adjust Quantity/Value on Hand.

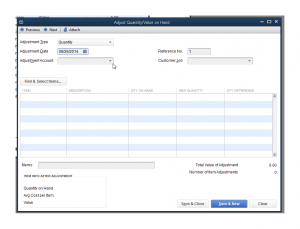

Then make the Adjustment Type – Total Value. The adjustment date will be the date in which you received the inventory. The adjustment account will be the Clearing Shipping Expense Account you created in the previous step. The next step would be to select the inventory item that needs to be adjusted, widgets in our example. Then add the Total Value plus the Shipping Cost as the new value. This will make the average cost of the inventory equal to the original cost of the inventory plus the cost of the shipping.

Note that this method works with QuickBooks Pro and Premier because these versions use an average cost inventory valuation method. If you are using FIFO (first in first out) inventory valuation methods then this will not work because we are changing the valuation of the entire inventory account for that product and not just the last items that were ordered.

If you followed the steps correctly, your new inventory valuation would be $5.50 (in the example above) and the balance in the clearing shipping expense account will be $0.

Another alternative that would work with all inventory valuation methods would be to enter the invoice for the widgets and allocate the cost of the inbound shipping to the item costs (increasing the item cost so that it is the original cost owed to the supplier plus a portion of the shipping costs). Then in the expense tab you would enter a negative number for the amount of the shipping that you just allocated to the individual items on the item tab and the expense account you will use is the expense clearing account. Then you would record the third party shipping invoice to the same expense clearing account to zero out the account.

Following these directions will capitalize your shipping costs making your gross margin more accurate and in line with what is actually happening in your operations.

If you have any questions please feel free to leave a comment below.

Thank you for your time and subscribe to this blog to receive notifications for new posts I will be releasing.

rey

onYour topic is quite good and gave me idea how to account for the shipping cost and other overhead however, I was just wondering what to do if there are many items on one shipment and another shipment is coming for mixed items as well how are you going to treat this.

regards,rey

Ofir Gabay

onThese methods work for one item or many different items. If you have many items then simply allocate the shipping costs over each item individually.

For example, you can divide the total shipping cost by the total product cost of all of the items that you are receiving (including products coming in another shipment). This will give you a percentage of your shipping cost relative to your product cost. Then you simply multiply each line item by 1+ the percentage you calculated. At the end of the process your new COG will total the original cost plus the cost of shipping.

Saqib Murtaza

onHi,

It really helped, but please help me what to do if we have to pay the clearing expenses to the shipping agent.

Ofir Gabay

onAny expense associated with getting the inventory and making it ready for sale can be capitalized and included in the inventory cost. When you sell this inventory then you will move these costs from the inventory account into a cost of goods sold account. You can use any of the methods I outline in this post to allocate these expenses into the cost of inventory. I hope this helps.

Guolong Li

onThis helps. Thank you very much!

Hilary

onSome people have mentioned apportioning freight costs to products by value. Is it a common practice to apply freight costs by dimensional volume or weight? Does it have to align with how freight is charged? Or is it a case of where as long as it is reasonable and consistent, once method is as good as another?

Ofir Gabay

onIt is a very common practice to allocate freight costs by size or weight. Just like you mentioned, as long as you are consistent and the method you choose is reasonable then you are fine. I am probably going to produce a video showing how I use custom fields to allocate freight costs by item, so be sure to check out my YouTube Channel for that. Thank you for reading!

https://www.youtube.com/channel/UC0R-kRx5eCqNqnHVm7VqXUg

scott

onHi Ofir,

I’m about to start watching your YouTube videos. Thank you for this article, and those videos. I’m just wondering if you would be interested in creating a video to cover the custom fields you mention, and how to setup the accounts properly to deal with 3rd party shipping invoices please?

Cheers

Scott.

Ofir Gabay

onHi Scott,

Thank you for the kind words. This is one of the topics that are on the top of the list for future videos.

Thanks again,

Ofir

Abdul

onAs a small business owner without formal accounting background, yours is by far the best explanation I have had so far to help me better understand how to add landed cost in accounting software. I run a small small import and retail business. Sometimes various items are purchased from one supplier who then also charges for freight on the same invoice. Other times, purchases are made from various suppliers and delivered to a shipper who then charges for the container shipping cost separately. Of coarse there is then the import clearing charges on arrival. Could you tell me which of the methods you have mentioned above would be a good fit for me in Xero which I have just started using. Its a really big help knowing which account to assign each step to as you have done in your explanation above.

Eune Yoo

onHi there,

Thank you for your article. If the vendor is charging shipping cost on the invoice how would it be itemized? Is it a separate inventory part and each time I receive an item I would update the cost? Or is it considered an “Other Charge”?

Thank you,

Eune

Ofir Gabay

onYou need to include the vendor’s shipping cost as part of the inventory you are receiving. You can do so by allocating the shipping cost over the inventory received on the invoice proportionally in a way that makes the most sense to the business. This can be by size or cost…etc. I hope this helps!

Mike Vayvala

onWhat’s you take on accounting for Amazon sales commission as COGS vs expenses?

Ofir Gabay

onI like COGS since it is dependent on sales (their commission is not a fixed fee).

Dave

onHii, I am new to QuickBooks and this is very helpful to me.Thanks!